Empowering Organizations to Stop Financial Crime and Create a Safer World.

- Simplified Client & Product Onboarding

- Automated AML & KYC Due Diligence

- Centralized Client Lifecycle Management platform

Fenergo Client Lifecycle Management

Delivers Real ROI

in manual errors and volumes of client outreach, improving operational efficiencies & accuracy.

to transform your client onboarding & lifecycle experience with Fenergo.

codified into regulatory rules, enabling you to manage financial crime & regulatory compliance globally.

who have already unlocked revenue potential throughout the client lifecycle.

Explore our Client Lifecycle Management Solutions

Client Lifecycle Management

Digitally manage clients through every stage of the client lifecycle - from initial onboarding & Know Your Customer (KYC) to ongoing KYC reviews and client offboarding.

Learn more

Know Your Customer

Digitalize the end to end know your customer process for clients and counterparties throughout the entire client lifecycle. Simplify and automate due diligence with pre-packaged KYC rules and workflows, ensuring effective customer due diligence and regulatory compliance.

Learn more

Client Onboarding

A single, integrated client onboarding solution to connect stakeholders and provide a single client view. Streamline and automate end-to-end onboarding journeys, including KYC and risk, digital client outreach, client risk assessment and PEP and sanctions screening.

Learn more

Transaction Monitoring

Detect suspicious activity in real-time, trigger alerts, investigate results and report financial crime to authorities. Transform transaction monitoring effectiveness, reduce false positives and manage risk exposure to combat Money Laundering and Terrorist Financing.

Learn more

Regulatory Compliance

Simplify compliance with global regulations including ESG, Tax, Investor Protection and more. Accelerate client and counterparty classifications through pre-packaged regulatory classification frameworks and tooling, as well as automated risk and suitability assessments.

Learn more

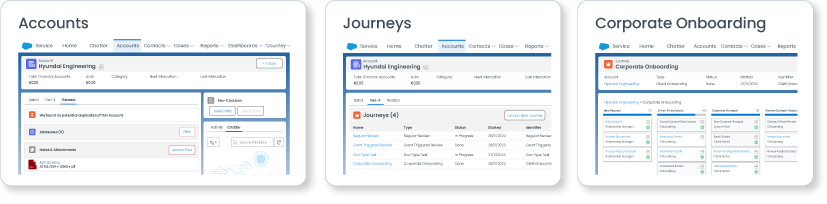

CLM for Salesforce

Provide Relationship Managers with real-time visibility over the end-to-end onboarding process directly from Salesforce, leveraging automatic updates & streamlined outreach, eliminating the reliance on ineffective email updates and duplicate requests for information.

Learn more

Advisory, Data & Product Partners

Fenergo partners with a host of market-leading advisory, implementation, data and product partners to create an end-to-end ecosystem of services and solutions for our clients.

.svg)

Our Clients Love What We Do

…helps fulfil our objective and align banking with evolving client expectations and preferences.

"Our mission is to enable the business and growth aspirations of clients across the globe through effortless, seamless and easily accessible banking services and solutions. Fenergo’s cloud-native CLM solution, which fast-tracks and automates the client onboarding process, helps fulfil our objective and align banking with evolving client expectations and preferences in this fast paced, increasingly touchless world."

Mr. Sael Al Waary,

Deputy Group Chief Executive Officer2,

Bank ABC

…helps fulfil our objective and align banking with evolving client expectations and preferences.

"Our mission is to enable the business and growth aspirations of clients across the globe through effortless, seamless and easily accessible banking services and solutions. Fenergo’s cloud-native CLM solution, which fast-tracks and automates the client onboarding process, helps fulfil our objective and align banking with evolving client expectations and preferences in this fast paced, increasingly touchless world."

Mr. Sael Al Waary,

Deputy Group Chief Executive Officer2,

Bank ABC

…helps fulfil our objective and align banking with evolving client expectations and preferences.

"Our mission is to enable the business and growth aspirations of clients across the globe through effortless, seamless and easily accessible banking services and solutions. Fenergo’s cloud-native CLM solution, which fast-tracks and automates the client onboarding process, helps fulfil our objective and align banking with evolving client expectations and preferences in this fast paced, increasingly touchless world."

Mr. Sael Al Waary,

Deputy Group Chief Executive Officer2,

Bank ABC

…helps fulfil our objective and align banking with evolving client expectations and preferences.

"Our mission is to enable the business and growth aspirations of clients across the globe through effortless, seamless and easily accessible banking services and solutions. Fenergo’s cloud-native CLM solution, which fast-tracks and automates the client onboarding process, helps fulfil our objective and align banking with evolving client expectations and preferences in this fast paced, increasingly touchless world."

Mr. Sael Al Waary,

Deputy Group Chief Executive Officer2,

Bank ABC

%201.svg)

Recognition by Leading Analysts

Chartis RiskTech100® 2022 – Research Report

Aite Report ranks Fenergo Best-in-Class for Client Lifecycle Management Solution