%20(1).webp)

Digitally Transform the Client Lifecycle

Commercial Banking clients expect a fast and frictionless onboarding experience. The account opening process offers your clients a valuable, first impression on their new banking relationship. This needs to be fast, efficient and client centric.

Fenergo Client Lifecycle Management (CLM) enables Commercial & Business Banks to digitally transform the end-to-end client experience, future-proof regulatory compliance and optimize operational efficiencies.

Reimagine the Client Experience With Fenergo CLM

Fenergo CLM automates and streamlines internal processes to create tangible operational efficiencies that transform the client experience for commercial and business banks, all the while keeping the bank safe from new and evolving regulatory obligations.

Transform Client Experience

The ability to deliver drastically improved efficiencies in account opening times through a digital process result in a reduction in system hand-offs, integration, re-keying and duplication of data.

Achieve Faster Time to Revenue

By reducing average onboarding times and abandonment rates during account opening, your firm can achieve a much faster time to revenue.

Unlock Revenue Potential

With faster more efficient proceses and an improved client experience, you can successfully cross-sell and up-sell to existing clients, whilst attracting more new business with a greater competitive advantage.

Essential Reading for Commercial & Business Banks

Discover the latest industry trends through our expert whitepapers, exploring how banks must continue to adapt in an ever evolving sector.

WHITEPAPER: Global and Local Payments for Commercial Banking

Commercial Banking is undergoing significant changes due to market dynamics and rapid technological innovations. This Whitepaper covers:

- The challenges faced by banks and how they can accelerate change

- The role of a centralized Client Lifecycle Management platform

- Best practices for striking the balance between compliance and innovation.

WHITEPAPER: Rising Tides of Change: Exploring the Fast-Paced Realm of Commercial Banking

The whitepaper delves into strategies for Commercial Banks to remain competitive in the evolving financial sector including; Reimagining the customer experience, partnering with the right technology partners, delivering a compliance-by-design approach & a single client view, as well as saving exponentially on future maintenance costs.ANALYST REPORT: Fenergo recognized as the Category Leader in the RiskTech Quadrant®

This is the fourth consecutive year where Fenergo has been classified as the Category Leader for KYC Solutions. Follow this link to download the report.Fenergo Clm for Commercial & Business Banks Delivers:

.svg)

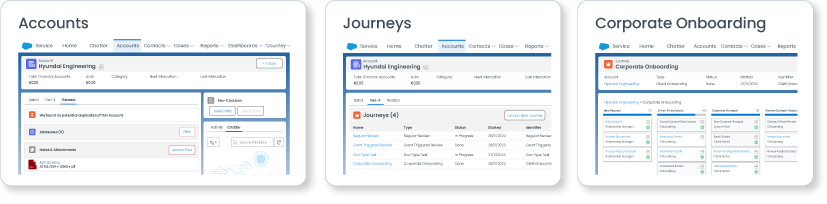

Fast & Frictionless Client Journeys

Fenergo CLM is a sophisticated workflow and case management solution that enables financial institutions to provide automated, seamless and compliant digital account opening services, in addition to client and product maintenance and refresh processes. It streamlines the product request and account opening processes, automates financial crime and regulatory compliance processes and, ultimately, empowers commercial and business banks to delight clients during every stage of their relationship.

.svg)

Policy-Driven Compliance

Fenergo CLM enables financial firms to comply with a wide range of local and global regulations, including Anti-Money Laundering (AML), Know-Your-Customer (KYC) and data privacy rules.

With Fenergo CLM, compliance teams are no longer isolated in siloed systems. Front, middle and back-office teams are connected throughout the onboarding, maintenance, and refresh process, significantly reducing manual effort by enabling straight through processing with our dynamic workflow system.

.svg)

Enterprise-Wide single Client View

Fenergo CLM delivers an enterprise-wide, single client view that ensures clean, centralized client data and documentation are maintained throughout the client lifecycle journey. This central repository enables compliance and onboarding teams to work off one client record and is available for consumption by other applications within the banking ecosystem.

.svg)

Digitalized Product Enablement Processes

Fenergo’s Product Enablement domain provides a dynamic, automated solution that empowers financial institutions to easily capture, track, and maintain a product’s lifecycle within a business arrangement. This enables FIs to strengthen business decisioning, leverage accurate risk management, achieve precise compliance and regulatory reporting, and deliver enhanced process management and data quality.

Find Out More

Contact us and find out how Fenergo CLM for Commercial & Business Banking can deliver an exceptional client experience through increased operational efficiencies.

.webp)

.svg)

.svg)